IHS iSuppli's research shows that the Japanese earthquake and tsunami caused supply disruptions and pushed up the prices of major storage devices, which will make global chip sales in 2011 higher than previous forecasts.

IHS iSuppli's research shows that the Japanese earthquake and tsunami caused supply disruptions and pushed up the prices of major storage devices, which will make global chip sales in 2011 higher than previous forecasts.

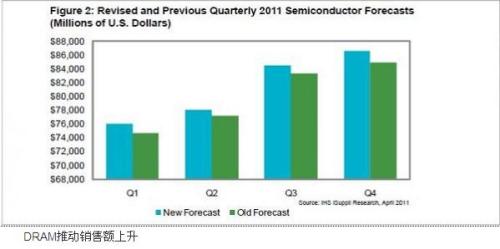

IHS iSuppli’s latest semiconductor forecast for 2011 was released on March 30. Semiconductor sales are expected to increase 7.0% this year, up from 5.8% expected in early February. It is now expected that global semiconductor sales in 2011 will reach US$325.2 billion, which is higher than the previous forecast of US$322.1 billion.

In each quarter of 2011, semiconductor sales will be higher than previous estimates, as shown in the figure.

The biggest factor in the semiconductor market's upward adjustment caused by DRAM-driven sales growth is the improvement in DRAM sales outlook. IHS iSuppli's latest forecast raised its DRAM sales forecast for 2011 by 6.6 percentage points. It is currently forecast that the market will only decline by 4% this year, while the previous forecast is a 10.6% decline. The improvement in DRAM sales outlook is entirely due to the increase in average sales prices in the first quarter due to the impact of the earthquake.

The earthquake will result in a 1.1% reduction in global DRAM shipments in March and April. Coupled with other factors, it helped stabilize the contract price of DRAM in March. March is usually weak for DRAM, and the price will drop by about 3%. The current price stability in March is of great significance. It will greatly enhance the annual DRAM sales.

The average contract price for DRAM in April is expected to rise from flat to 2%, while the previous forecast is a 3-4% drop.

Japan's two DRAM factories were not damaged in this earthquake. However, Elpida’s production at a chip assembly plant in the Akita region was interrupted, causing shipments to decline.

It is expected that the pressure of rising DRAM prices will weaken in the second half of this year.

Wafer Issues If the shortage of wafers deteriorates, DRAM prices may rise further later this year.

Japan is the world's major producer of silicon wafers, accounting for 60% of global supply. Silicon wafers are a key raw material for the production of semiconductors.

The major wafer supplier Shin-Etsu's 300-mm wafer production is still not normal. The company's Shenji and Baihe plants are closed, and the two plants together account for about 20% of global wafer production.

Therefore, the supply of 300mm bare wafers may become a problem for memory manufacturers. If the supply problem cannot be solved in the short term, the production efficiency will be affected after the bare wafer inventory is depleted. In particular, DRAM production will be affected when the number of wafers in the manufacturing supply chain drops to less than 50% of the normal level.

From the beginning of October will face this possibility, leading to further rise in DRAM prices.

Author: Dale Ford, senior vice president of market intelligence firm IHS; Mike Howard, IHS chief DRAM analyst.