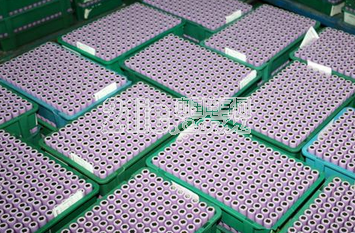

The power battery is the power source that provides the power source for the tool, and refers to the battery that powers the electric car, the electric train, the electric bicycle, and the golf cart. This article refers to the address: http:// At the end of 2016, the Ministry of Industry and Information Technology issued the "Regulations for Automotive Power Battery Industry" (2017) (Draft for Comment), of which Article 8 proposes that the annual production capacity of lithium-ion power battery cells is not less than 8GWh watt-hour. When the news came out, it caused an uproar in the industry. The target is 40 times the annual production capacity of lithium-ion power battery cells specified in the previous "Regulations for Automotive Power Battery Industry", equivalent to more than 10 billion production value. There are only a handful of companies that meet the standards. In 2016, the enterprises with a capacity of 8GWh watt-hours were only BYD and Ningde era. The main purpose of the 8GWh production threshold is to concentrate resources and cultivate large-scale manufacturing enterprises with international competitiveness. This initiative has been supported by some powerful enterprises, but it has also produced some negative effects: the company has followed the policy to expand production. At the same time, it has caused tremendous pressure on the overcapacity of power battery. A large amount of funds are concentrated on expanding the production line and affecting the investment in technology research and development, and ignoring the improvement of product quality in pursuit of production quantity. It is a double-edged sword to regulate the power battery industry with production capacity indicators and to drive the expansion of production capacity by policies. Under the current situation, the invisible hand of the market to promote industrial development and form a benign situation of survival of the fittest has become the most urgent call of enterprises. A few days ago, the China Electric Vehicles 100 People's Association and the China Chemical and Physical Industry Association Power Battery Application Branch formed a "collaborative development - 2017 new energy vehicle industry exploration tour" research team and more than ten complete vehicles and power battery companies, The person in charge of the company discussed the current development status of the enterprise, the technical route, and the pain points and difficulties faced by the current enterprise. Among them, the expansion of the capacity of power battery companies has become the focus of research groups and enterprises. Improve the entry barrier and help protect the good currency In recent years, the number of power battery companies in China has grown rapidly. According to the statistics of the Ministry of Industry and Information Technology, from 2009 to 2015, the shipment of power batteries for new energy vehicles in China soared from 0.26 billion watt-hours to 16.34 billion watt-hours, just 6 years. The time has increased by more than 600 times. At the same time, the number of power battery companies supporting new energy vehicles has increased from dozens to more than 300 in 2016. A large part of these new power battery companies are diverted from other fields, and there are problems such as weak technical strength and lack of talent accumulation. The power battery industry faces problems such as low barriers to entry, mixed products, uneven product quality, and difficulty in ensuring product safety. It also presents a phenomenon of overcapacity in low-end products and has not yet formed a standardized and orderly market landscape. In the survey, many companies believe that if the power battery market is not regulated, the corresponding policies will be introduced, and the threshold for entry will be raised, and the vicious situation of bad money expelling good money will easily occur. The power battery is the core of electric vehicles and is related to the future of the entire industry. Since the power battery has high safety requirements, it is necessary to strictly control from material selection to production. Compared with small and medium-sized enterprises, large-scale manufacturing enterprises are more likely to achieve automated production, to ensure the consistency and safety of batteries, and their product quality and production efficiency are much higher than those of semi-automated or artificially produced SMEs. The influx of many smaller companies into the power battery industry will bring hidden dangers to the development of the industry. Japan, South Korea and other power battery powers to build a strong country has also provided evidence. Both countries have formed about three pillar power battery companies, and their technical strength and market share have obvious advantages. Wang Binggang, a special expert on the major technology of electric vehicles in the 863 Program, pointed out that China's power battery industry should learn from Japan's and South Korea's development strategies - concentrating resources to cultivate several large, core technology battery companies that can participate in international competition. The 8GWh capacity threshold will bring huge survival pressure to SMEs, but it is a good news for large enterprises with technical and capital accumulation advantages. Under the pressure of high production threshold, the strong will stand out, forming the survival of the fittest, and the good money will drive out the bad money. Since 2017, the echelon differentiation speed of power battery companies has gradually accelerated. Judging from the situation of the research group visiting the whole vehicle enterprise, the supporting battery enterprises selected by the whole vehicle enterprises have stabilized, mainly concentrated in a few large-scale battery enterprises such as Ningde Times, Waterma, Guoneng Battery and Guoxuan Hi-Tech. Supply chain concentration is rapidly increasing. With the threshold of production capacity, it is easy to cause heavy output and light weight. 2017 is a year of concentrated release of power battery capacity. Under the promotion of “8GWh production capacity thresholdâ€, in order to avoid being eliminated in the new round of competition, the company has accelerated the pace of expansion of production capacity. The capital investment in building a power lithium battery plant includes civil works, equipment and installation, working capital and other expenses. According to analysis, the production line of 1 billion watt-hours requires at least 360 million yuan for domestically produced equipment, and 1 billion yuan for imported automatic equipment. In order to achieve the targets, enterprises need to invest huge amounts of money to expand the production line, and the investment in technology research and development will inevitably be affected, resulting in the product quality cannot be continuously improved. Some experts said that at present, China's power battery industry has a shortage of high-end production capacity and low-end overcapacity, and the product quality is worrying. With the threshold of production capacity, it is easy for enterprises to ignore the quality in pursuit of quantity. Chen Qingtai, chairman of the China Electric Vehicle Hundred People's Association, once said that under the favorable policies, many new energy auto companies are busy increasing production and competing to attract goods to battery companies, in order to get battery products in time and even reduce quality requirements. In order to guarantee supply, some battery component companies have lowered quality standards, relaxed management, and slowed down the pace of technology research and development. A complete vehicle company has even conducted a comprehensive test on the batteries of many domestic and foreign enterprises. The results reflect that there is a certain gap between the manufacturing level of China's electric core and the advanced enterprises in Japan and South Korea. According to relevant data, the yield rate of domestic battery companies is around 95%, while that of Japanese and Korean companies is over 99%. China's new energy auto industry still has a long way to go if it is truly competitive internationally. Therefore, in terms of power battery enterprise management, the government should pay more attention to the improvement of enterprise innovation capability and technology level while encouraging enterprises to expand their scale. Enterprises have expanded their power battery capacity overcapacity crisis The 8GWh production capacity threshold is to form a leading enterprise and improve the international competitiveness of China's power battery industry. However, it has brought a lot of pressure to most power battery companies. After all, there are few companies that can meet this condition. Driven by the 8GWh capacity threshold, various power battery companies have accelerated the pace of expansion. Large-scale battery companies such as BYD plan to achieve 26GWh in 2018. In 2020, the lithium battery output will increase to 50GWh in 2020, Tianjin Power 2020 The annual battery capacity will reach 20GWh. In addition, among the battery companies that the research team recently visited, all of them have developed expansion plans in recent years, and many companies have established new production lines and gradually put them into use. For example, Camel New Energy will have a planned production capacity of 10GWh by 2020, and CATIC Lithium will have a planned production capacity of 14.5GWh by 2020. Thornton New Energy also plans to achieve a capacity target of 8GWh in October 2017. Some experts pointed out that in terms of the current expansion plan of power battery companies, the total production capacity exceeds 170Gwh/year, and the production capacity is already more than 7 times of the demand. According to the market sales ratio of electric buses and electric passenger cars 1:10, 170Gwh can meet the total demand of 500,000 electric buses and 5 million electric passenger cars per year, and according to China's new energy vehicles. Development planning estimates, this may be China's goal after 2025. Enterprises call for capacity expansion based on market demand With the promotion of a number of favorable policies, China has quickly started the electric vehicle market, which has enabled the industry to form a larger scale in a relatively short period of time. But the policy is to put a double-edged sword, while promoting the industry, it also has its own uncertainty and unsustainability. Under the current situation, companies are calling for market capacity to determine capacity expansion rather than a one-size-fits-all digital indicator. Driven by the policy, a large amount of capital is invested in the plan for the expansion of power battery capacity. From the situation of the research team, the company is very firm in the road of expanding production, but the pressure is not small. The production line of the power battery is fast, and iterates once every 2-3 years. Otherwise, it is difficult to guarantee the leading edge of the product and thus lose its competitive advantage. The replacement of equipment requires a lot of capital costs, which brings huge operational pressure to small and medium-sized enterprises with weak financial strength. Some business leaders pointed out that the current power battery technology, process and other updates are very fast, and the completed production line is likely to be out of service and can not meet the needs of new processes and was eliminated, resulting in great waste of resources. It is understood that there is still a big gap between domestic equipment and the international advanced level. Many enterprises choose to introduce more advanced imported equipment in order to guarantee product quality, and the price is also relatively expensive, usually several times that of domestic equipment. For example, Henan Lidong Power Supply Co., Ltd. visited by the research team, according to the person in charge, the company insists on selecting imported equipment with small capacity but ensuring excellent product quality to improve product quality. The current annual production capacity is 1GWh, but it is also invisible. Adding cost pressure to the company. At present, the development strategy of enterprises is mainly based on policy orientation, and the uncertainty of policies leads to the failure of enterprises to formulate long-term and stable technical routes and development strategies, which is not conducive to the sustainable and healthy development of the industry. In response to the "8GWh threshold" problem, most companies suggest that the production capacity index should not be used as a "roadblock" for the development of power battery companies. The production capacity planning should be based on market demand, adhere to the market-oriented, and guide enterprises according to the price signal reflecting the supply and demand gap. Production, naturally forming a benign situation of survival of the fittest. A one-size-fits-all policy indicator will lead companies to blindly expand production to meet demand, neglect market needs and product quality, resulting in great waste of resources. Portable Energy Storage Outdoor Langrui Energy (Shenzhen) Co.,Ltd , https://www.langruibattery.com